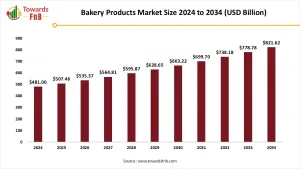

The global bakery product market was valued at USD 476 billion in 2024. It is projected to reach approximately USD 795 billion by 2034, growing at a CAGR of 5.2% over the forecast period (2025–2034). Baked goods are among the most widely consumed food products globally, ranging from staple breads to gourmet patisserie items. The market is characterized by the increasing presence of health-oriented products, artisanal innovations, and ready-to-eat offerings, especially in urban and semi-urban markets.

Market Overview

The global bakery product market is a dynamic and evolving sector of the food industry, encompassing a wide array of offerings including bread, cakes, pastries, cookies, biscuits, and specialty baked items. Fueled by shifting consumer preferences, rising urbanization, and the demand for convenience and indulgence, the bakery sector continues to show strong growth across regions and demographics.

Get a Sample Now: https://www.towardsfnb.com/download-sample/5477

Market Growth Factors

- Rising Demand for Convenience and On-the-Go Foods

With fast-paced lifestyles, consumers increasingly seek ready-to-eat or easy-to-prepare bakery items, such as packaged breads, croissants, muffins, and sandwich rolls.

- Expansion of the Organized Retail Sector

The growth of supermarkets, hypermarkets, bakeries, and café chains has enhanced the accessibility and visibility of a wide variety of baked goods.

- Health-Conscious Consumption Trends

Demand is growing for gluten-free, low-sugar, high-fiber, and whole grain bakery items, reflecting a shift toward healthier diets.

- Innovation in Product Varieties and Flavors

The bakery industry thrives on innovation from fusion pastries and ethnic breads to organic and protein-rich alternatives meeting diverse consumer tastes.

- Growth in Foodservice and HoReCa Channels

The increasing number of cafes, QSRs (Quick Service Restaurants), and hotels around the world drives demand for fresh and frozen baked goods, especially in breakfast menus and desserts.

Restraining Factors

Rising Health Concerns Related to Bakery Product Consumption May Hinder Market Growth

While bakery products particularly bread remain staple foods in regions such as the U.S. and much of Europe, their consumption has been declining due to growing health concerns. The increasing prevalence of obesity and diabetes has led consumers to become more cautious about their dietary choices, thereby impacting demand for traditional bakery items.

A major concern is the widespread use of refined flour in baked goods, which has been linked to various health issues, including weight gain and poor metabolic health. Additionally, many bakery products are high in sugar and carbohydrates, lacking the nutritional balance required for a healthy diet. These factors contribute to the perception of baked goods as unhealthy, restraining market growth. As health awareness continues to rise globally, especially in developed markets, the bakery industry may face challenges unless it innovates with healthier, more balanced product offerings.

Market Opportunities

- Premium and Artisanal Product Lines

The premiumization of bakery products offering artisan breads, handmade pastries, and gourmet cakes—is appealing to discerning consumers willing to pay more for quality and experience.

- Expansion into Emerging Economies

Countries across Asia-Pacific, Africa, and Latin America present vast opportunities as bakery consumption rises alongside increasing urban populations and Western influence.

- Plant-Based and Clean-Label Innovations

There’s significant potential in vegan, plant-based, and clean-label baked goods made without artificial preservatives, additives, or animal-derived ingredients.

- E-commerce and Direct-to-Consumer (DTC) Models

Online grocery platforms and DTC brands are enabling bakeries to reach broader audiences, particularly for specialty, organic, or gourmet baked goods.

- Frozen and Long-Shelf-Life Products

The growth of frozen bakery products with extended shelf life is meeting the demand for convenience in both retail and foodservice settings.

Grab the Databook and Discover Key Industry Insights Instantly: https://www.towardsfnb.com/download-databook/5477

Recent Developments in the Bakery Product Market

- February 2024: Base Culture, a well-known manufacturer of frozen bakery goods, announced the launch of its new Simply Bread line. This product range expands the company’s gluten-free offerings and features clean-label ingredients, catering to health-conscious consumers seeking transparency and dietary inclusivity.

- June 2023: Arva Flour Mills, one of North America’s leading commercial bakery mills, acquired the Full of Beans gluten-free product brand. This strategic acquisition supports Arva Flour Mills’ plan to launch its own gluten-free product range, aiming to broaden its consumer base and strengthen its presence in the health-focused bakery segment.

- April 2023: Britannia, a prominent Indian bakery product manufacturer, introduced its new millet bread, which is free from refined flour. With this innovation, Britannia became the first company in India to launch a health and wellness-focused organic bread product in the mainstream bread market, aligning with the country’s growing demand for nutritious alternatives.

Top Companies in the Bakery Product Market

Key Players Launching Innovative Bakery Products to Capture Market Share

Leading companies such as Mondelez International, The Kellogg Company, Associated British Foods, General Mills, and Grupo Bimbo are actively shaping the bakery products market. In response to rising consumer health consciousness, these key players are increasingly focusing on innovation to meet evolving dietary preferences. For example, in November 2021, Bimbo Bakeries USA, a subsidiary of Grupo Bimbo, introduced a new product under its Sara Lee Delightful line—Soft & Smooth Wheat Bread. This variety is made with whole grains and contains no added sugar, catering to health-conscious consumers seeking nutritious bread options.

Similarly, in September 2021, Mondelez International launched a Limited Edition Pokémon x Oreo cookie line. This strategic move was aimed at capturing the attention of younger demographics and enhancing brand engagement through novelty and collectible appeal. These examples highlight how major players are blending health-focused product development with creative marketing to strengthen their market position and cater to a broader consumer base.

- Grupo Bimbo (Mexico)

The world’s largest bakery company with a vast product portfolio including bread, rolls, cakes, and snacks under brands like Bimbo, Sara Lee, Entenmann’s, and Oroweat. - Mondelez International (USA)

Known for biscuits, cookies, and crackers with iconic brands like Oreo, Chips Ahoy!, BelVita, and LU. - Nestlé S.A. (Switzerland)

While primarily a beverage and confectionery giant, Nestlé is active in the bakery segment with chilled doughs and baking mixes. - Britannia Industries (India)

A leading player in India’s bakery market, offering breads, biscuits, cakes, and rusks, widely consumed across the subcontinent. - Yamazaki Baking Co., Ltd. (Japan)

Japan’s top bakery brand, known for sweet breads, packaged cakes, and pastries, and expanding across Asia. - Hostess Brands (USA)

Specializes in packaged snack cakes and pastries, including iconic items like Twinkies and Ding Dongs. - Aryzta AG (Switzerland)

A major supplier of frozen bakery products to foodservice and retail sectors across Europe and North America. - Finsbury Food Group (UK)

UK-based producer of celebration cakes, bread, and morning goods, both under own brands and private label.

Get detailed pricing and reports now : https://www.towardsfnb.com/price/5495

Segmentation Analysis

By Product Type

- Bread & Rolls

- White Bread

- Multigrain Bread

- Buns & Rolls

- Cookies & Biscuits

- Chocolate Chip, Cream-filled, Digestive, Crackers

- Cakes & Pastries

- Cupcakes, Muffins, Swiss Rolls, Cream Cakes

- Frozen Bakery Products

- Frozen Dough, Par-Baked Goods, Ready-to-Bake Items

- Artisan & Specialty Baked Goods

- Sourdough, Ethnic Breads, Gluten-Free Pastries

- Others

- Rusks, Tarts, Pies, Pizza Bases, Doughnuts

By Ingredient

- Wheat

- Rye

- Oats

- Corn

- Barley

- Multigrain & Seeds

- Alternative Flours (almond, rice, coconut)

By Distribution Channel

- Supermarkets & Hypermarkets

- Bakery Chains & Artisan Bakeries

- Convenience Stores

- Online Retail

- HoReCa (Hotels, Restaurants, Cafés)

- Specialty Health Stores

Regional Insights

North America

- A mature market with high consumption of packaged breads, snack cakes, and artisan pastries.

- Innovation centers around clean-label, gluten-free, and low-carb products.

- U.S. and Canada have strong penetration of frozen and functional bakery items.

Europe

- Known for its traditional and artisan baking culture, with high demand for sourdough, croissants, and regional pastries.

- Countries like France, Germany, UK, and Italy are major markets.

- Preference for organic and premium baked goods continues to grow.

Asia-Pacific

- Fastest-growing region, led by rising consumption in China, India, Japan, South Korea, and Southeast Asia.

- Increasing demand for packaged bread, Western-style cakes, and fusion bakery items.

- Growth in frozen and convenience-based offerings in urban areas.

Latin America

- Growing consumption of both traditional and packaged bakery goods.

- Countries like Brazil, Mexico, and Argentina show strong demand for sweet biscuits and buns.

- Healthier alternatives and premium options are gaining traction.

Middle East & Africa (MEA)

- Steady growth, particularly in GCC countries due to Western lifestyle adoption and tourism.

- Halal-certified bakery items are a growing category.

- Egypt and South Africa emerging as key local markets with rising bakery consumption.

Outlook and Future Opportunities

The global bakery product market is a blend of heritage and innovation. As health awareness, urban lifestyles, and digital commerce reshape food consumption, baked goods are evolving from simple staples to functional, gourmet, and sustainable products.

Success in this market will depend on a brand’s ability to diversify its portfolio, tailor to local tastes, and stay ahead of health and sustainability trends. With consistent consumer demand and product innovation, the bakery sector is set to rise much like the dough it champions.