The global alternative sweeteners market is undergoing significant expansion as health-conscious consumers and food manufacturers seek low-calorie, low-glycemic, and natural sugar substitutes. The rise in metabolic disorders, coupled with a global shift toward clean-label and plant-based food and beverages, has positioned alternative sweeteners as a vital component of the modern diet.

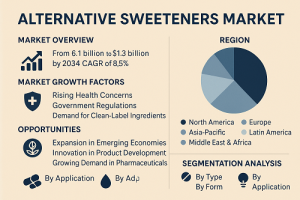

According to recent market data, the alternative sweeteners market was valued at USD 6.1 billion in 2024, and it is projected to grow to approximately USD 13.9 billion by 2034, exhibiting a CAGR of 8.5% during the forecast period (2025–2034). From stevia and monk fruit to xylitol and erythritol, alternative sweeteners are finding applications across sectors like food & beverages, pharmaceuticals, personal care, and nutraceuticals.

Market Overview

The global sugar substitutes market is highly competitive, with numerous active players contributing to its growth. Key strategies employed by leading companies include product innovation, mergers and acquisitions, strategic partnerships, and market expansion initiatives. Major industry participants include Cargill Inc., Heartland Food Products Group, DuPont de Nemours, Inc., and Ingredion Inc., among others.

Get a Sample Now: https://www.towardsfnb.com/download-sample/5477

Market Growth Drivers

Several macro and microeconomic factors are contributing to the robust growth of the alternative sweeteners market:

- Rising Health Concerns

The increasing global prevalence of obesity, type 2 diabetes, and cardiovascular diseases is prompting consumers to reduce their sugar intake. Alternative sweeteners, especially natural ones like stevia and monk fruit, are gaining traction as healthier sugar replacements.

- Government Regulations and Sugar Taxes

Regulatory bodies in countries such as the UK, Mexico, and parts of Southeast Asia have implemented sugar taxes on high-sugar food and beverages. These regulations are driving food manufacturers to reformulate their products using alternative sweeteners to avoid penalties and appeal to health-conscious consumers.

- Demand for Clean-Label and Natural Ingredients

The clean-label movement has bolstered demand for plant-derived sweeteners such as stevia and agave nectar. Brands are increasingly using natural sweeteners to meet consumer expectations around transparency and sustainability.

- Growth of Functional and Low-Calorie Food & Beverages

The explosion of the functional food market including protein bars, sports drinks, keto snacks, and sugar-free beverages is directly fueling the demand for sweeteners that deliver sweetness without compromising caloric content.

Opportunities in the Alternative Sweeteners Market

- Expansion in Emerging Economies

Markets in India, China, and Southeast Asia represent immense potential due to growing urbanization, changing dietary patterns, and increasing middle-class disposable income. These regions are becoming major consumer bases for sugar-free products, beverages, and health supplements.

- Innovation in Product Development

Ongoing R&D in fermentation technology and bioconversion processes is enabling the production of next-generation sweeteners like allulose and tagatose with improved taste, texture, and metabolic benefits.

- Growing Demand in Pharmaceuticals and Personal Care

Alternative sweeteners are increasingly used in oral care products, syrups, chewable tablets, and cough lozenges as sugar substitutes. With the pharmaceutical industry embracing sugar-free formulations, this vertical presents a promising avenue for growth.

- Personalized Nutrition and Diabetic-Friendly Products

The rise of personalized nutrition and low-GI foods is aligning perfectly with the functional benefits of sweeteners like isomalt, erythritol, and xylitol, offering manufacturers a chance to create customized dietary solutions.

Grab the Databook and Discover Key Industry Insights Instantly: https://www.towardsfnb.com/download-databook/5477

Recent Developments

- June 2022 – With rising consumer interest in natural food production and animal-based products, the use of plant-based feed additives in animal nutrition is showing significant growth potential. In response, Cargill, a global leader in agribusiness, announced that it had entered into a binding agreement to acquire Delacon, a leading expert in plant-based phytogenic additives. This acquisition is aimed at supporting the growing demand for sustainable animal feed solutions.

- June 2022 – On June 9, 2022, Tate & Lyle PLC (T&L) completed its acquisition of Quantum Hi-Tech (Guangdong) Biological Co., Ltd., a prominent Chinese company specializing in prebiotic dietary fibers. This acquisition follows the announcement made on March 31, 2022, regarding the signing of a conditional agreement, marking a strategic move to strengthen Tate & Lyle’s presence in the functional ingredients sector in Asia.

Top Companies in the Alternative Sweeteners Market

- Cargill, Incorporated

- Dabur India Ltd.

- Foodchem International Corporation

- PureCircle

- Roquette Frères

- Capilano Honey Ltd.

- Beeyond the Hive

- ADM (Archer Daniels Midland Company)

- Ingredion

- Pyure Brands LLC

- CELANESE CORPORATION

- Kerry Group PLC

- DuPont Nutrition & Health

- Tate & Lyle plc

Get detailed pricing and reports now : https://www.towardsfnb.com/price/5495

Segmentation Analysis

By Type

- High-Intensity Sweeteners (HIS)

- Stevia

- Aspartame

- Sucralose

- Saccharin

- Acesulfame Potassium (Ace-K)

- Low-Intensity Sweeteners

- Sorbitol

- Mannitol

- Xylitol

- Erythritol

- Novel & Rare Sugars

- Allulose

- Tagatose

- Natural Sweeteners

- Monk Fruit

- Agave Syrup

- Honey Powder

- Coconut Sugar

By Form

- Powder

- Liquid

- Crystal

By Application

- Food & Beverages

- Dairy Products

- Confectionery

- Bakery

- Beverages

- Pharmaceuticals

- Nutraceuticals

- Personal Care

- Others (e.g., Animal Feed)

Regional Insights

North America

- North America holds a leading market share, driven by increased health awareness, sugar tax policies, and the widespread availability of sugar-free and low-calorie products. The U.S. market, in particular, shows high demand for stevia, erythritol, and monk fruit-based products.

Europe

- Europe is witnessing significant growth, especially in countries like Germany, the UK, France, and the Netherlands, due to strict regulations around added sugar content and a growing vegan population. The EU’s Novel Food Regulation is also streamlining approval for newer sweeteners.

Asia-Pacific

- Asia-Pacific is the fastest-growing region in the alternative sweeteners market, with China, India, Japan, and South Korea leading the way. The rise in diabetic population, aging demographics, and urban dietary shifts are driving demand. China also plays a crucial role as a key production hub for stevia and sugar alcohols.

Latin America

- Countries like Brazil and Mexico are key markets, with governments implementing sugar taxes and large beverage companies reformulating their product lines using non-caloric sweeteners.

Middle East & Africa

- The region is emerging steadily due to an increase in health awareness, urbanization, and the introduction of Western dietary habits. Consumer demand for functional beverages and diabetic-friendly products is on the rise.

Outlook and Future Opportunities

The alternative sweeteners market is poised for substantial growth over the next decade, driven by health consciousness, regulatory shifts, and food industry innovation. As the demand for natural, clean-label, and low-glycemic ingredients grows, alternative sweeteners will remain central to product development across food, beverage, and healthcare sectors.

Companies that invest in R&D, sustainability, and regional expansion strategies will be best positioned to lead this evolving market. Whether it’s a sugar-free soft drink, a keto protein bar, or a diabetic-safe supplement, alternative sweeteners are becoming the new sweet standard.