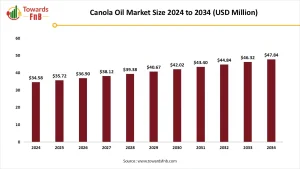

The global canola oil market was valued at USD 34.58 million in 2024 and is expected to expand at a compound annual growth rate (CAGR) of 3.30% from 2024 to 2030. The market has witnessed notable growth in recent years, primarily fueled by rising consumer awareness of the health benefits linked to canola oil. Renowned for its low saturated fat content and rich omega-3 fatty acid profile, canola oil is increasingly favored by health-conscious individuals aiming to lower their risk of chronic conditions such as heart disease.

Market Overview

The global canola oil market is witnessing sustained growth due to its reputation as a heart-healthy oil rich in omega-3 fatty acids and low in saturated fats. Known for its versatility, light flavor, and nutritional profile, canola oil is used extensively in cooking, baking, frying, food manufacturing, and increasingly in biodiesel production.

As of 2024, the global canola oil market size is valued at USD XX billion and is projected to grow steadily through 2034. Health-conscious consumers, expanding food service industries, and increasing industrial applications are fueling demand across developed and emerging economies.

Get a Sample Now: https://www.towardsfnb.com/download-sample/5477

Market Growth Factors

- Rising Health Awareness

The increasing consumer shift towards healthier edible oils has significantly boosted demand for canola oil. It contains high levels of monounsaturated fats and alpha-linolenic acid (ALA), which are known to reduce the risk of cardiovascular disease.

- Growing Popularity of Plant-Based Diets

Canola oil is a staple in vegan and vegetarian diets due to its plant origin and nutritional content. As global dietary preferences shift toward plant-based alternatives, demand is rising in both retail and foodservice sectors.

- Expanding Food Processing Industry

Canola oil’s neutral flavor and high smoke point make it ideal for deep frying, baking, and processed food production. It is widely used in margarines, salad dressings, and snacks, driving consistent demand from commercial food manufacturers.

- Biofuel Industry Growth

Canola oil is also a feedstock in biodiesel production, especially in regions prioritizing renewable energy. With environmental regulations tightening globally, this alternative energy application is gaining momentum.

Key Market Opportunities

- Penetration in Emerging Markets

Countries in Asia, Africa, and Latin America present untapped potential due to growing middle-class populations, rising disposable income, and increased awareness of healthier cooking oils.

- Expansion of Cold-Pressed and Organic Segments

Consumers are showing greater interest in cold-pressed and organic canola oil due to their minimal processing and perceived health benefits. This trend is creating lucrative opportunities for premium brands.

- E-commerce and Direct-to-Consumer Models

Online grocery platforms are offering a wider range of edible oil options, making it easier for niche brands to reach health-conscious consumers directly, bypassing traditional retail limitations.

- Product Diversification & Branding

Flavored, fortified, or blended canola oils are gaining popularity. Brands that offer functional benefits (e.g., added antioxidants, vitamins) stand to gain from the value-added oil segment.

Grab the Databook and Discover Key Industry Insights Instantly: https://www.towardsfnb.com/download-databook/5477

Latest Market Developments

- May 2023 – Bunge Limited and Chevron Expand Global Supply Chain

Bunge Limited, in partnership with Chevron’s Renewable Energy Group Inc., a subsidiary of Chevron Corporation, acquired Chacraservicios S.r.l., an Argentina-based company, from the Italian-based Adamant Group. This strategic acquisition is aimed at strengthening Bunge and Chevron’s global supply chains by incorporating a new oil source. It is expected to support both companies in meeting the surging demand for low-carbon renewable feedstocks. - May 2023 – ADM Acquires Prairie Pulse Inc.

Archer Daniels Midland (ADM) Company announced the acquisition of Prairie Pulse Inc., which operates a pulse crop cleaning, milling, and packaging facility in Vanscoy, Saskatchewan, Canada. This acquisition enhances ADM’s capabilities in crop processing and supports its long-term growth strategy in the plant-based ingredient market, complementing its canola oil production operations. - April 2023 – Cargill Invests US$50 Million in Oilseed Crushing Facilities

Cargill Inc. revealed a US$50 million investment to upgrade and expand its oilseed crush facilities located in Newcastle, Narrabri, and Footscray. The expansion aims to boost production capacity and improve operational efficiency to meet the increasing demand for canola and cottonseed-based products from both domestic and international markets.

Top Canola Oil Company Insights

The canola oil market operates within a highly competitive environment, facing significant pressure from established edible oils such as soybean, palm, and sunflower oils. These alternative oils benefit from robust supply chains, well-established consumer bases, and economies of scale, allowing them to offer lower production costs. As a result, canola oil producers often find it challenging to compete purely on pricing.

Despite these challenges, the canola oil industry is supported by a group of influential players who continue to drive innovation and maintain high product standards. Leading companies such as Archer Daniels Midland Company (ADM), Bunge Limited, Cargill Inc., CHS Inc., Louis Dreyfus Company, and Richardson International Limited have leveraged advanced processing technologies, global distribution networks, and strategic investments in R&D. These efforts focus on improving crop yields, enhancing oil extraction efficiency, and developing healthier oil solutions to meet rising consumer demand.

Top Companies in the Canola Oil Market

These key players collectively shape the global canola oil industry and account for a significant share of the market:

- Archer Daniels Midland Company (ADM)

- Associated British Foods plc

- Bunge Limited

- Cargill Inc.

- Jivo Wellness Pvt. Ltd.

- Louis Dreyfus Company

- Richardson International Limited

- Wilmar International Ltd.

- American Vegetable Oils, Inc.

- Adani Wilmar

- The J.M. Smucker Company

- Arla Foods Amba

- Highwood Crossing Foods Ltd.

- La Tourangelle

- Sunora Foods, Inc.

- Parrish and Heimbecker, Limited

- Paterson Grain

- Huiles TITAN Oils Inc.

- Dalmia Continental Pvt. Ltd.

- Fuji Vegetable Oil Inc.

Get detailed pricing and reports now : https://www.towardsfnb.com/price/5495

Segmentation Analysis

By Type

- Refined Canola Oil

Widely used in cooking and food processing due to its neutral flavor and high smoke point. - Cold-Pressed Canola Oil

Gaining traction in premium markets for its natural extraction method and retained nutrients. - Organic Canola Oil

Certified organic variants are popular among eco-conscious and health-aware consumers.

By Application

- Food Industry

- Cooking oil

- Baking & frying

- Sauces and condiments

- Margarine & spreads

- Industrial

- Biodiesel production

- Lubricants & cosmetics (minor use)

- Retail/Household

- Bottled canola oil for home consumption

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Foodservice & HoReCa (Hotels, Restaurants, Cafés)

- Online retail is the fastest-growing channel, especially post-pandemic, while foodservice continues to drive bulk purchases.

Regional Insights

North America

- United States and Canada lead in both production and consumption. Canada is one of the world’s largest exporters of canola oil. The region benefits from health-driven consumer preferences and large-scale industrial use, including biodiesel.

Europe

- Western Europe has strong demand for organic and non-GMO canola oil. Germany, the UK, and France are key markets driven by culinary use and clean-label preferences. EU sustainability policies are also encouraging biofuel adoption.

Asia Pacific

- Emerging as a major growth engine due to rising populations, urbanization, and changing food consumption habits. China, India, Japan, and Australia are key contributors. India is seeing steady demand in urban areas, while Japan favors high-quality, cold-pressed variants.

Latin America

- A growing market with potential, especially in Brazil, Mexico, and Argentina. Government initiatives supporting renewable energy and healthier food options are opening doors for canola oil penetration.

Middle East & Africa (MEA)

- Gradual growth due to increasing urbanization and growing foodservice industries. Gulf countries are showing rising interest in healthier cooking oils for both retail and foodservice applications.

Outlook and Future Opportunities

The canola oil market is evolving in response to global trends toward healthier living, sustainable energy, and convenience. As demand grows across food, retail, and industrial sectors, manufacturers have ample opportunity to innovate through organic variants, value-added features, and targeted regional strategies.

Key stakeholders that focus on product differentiation, certification (organic/non-GMO), supply chain efficiency, and sustainability will be best positioned to thrive in this competitive market.