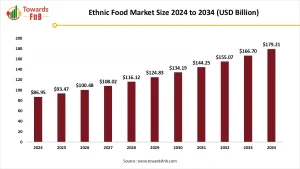

The global ethnic food market is valued at USD 56.2 billion in 2024 and is projected to reach approximately USD 98.7 billion by 2030, growing at a CAGR of 8.5%. The demand is driven by globalization, multicultural populations, culinary tourism, and a growing appetite for authentic, flavorful, and often healthier alternatives to conventional Western foods.

Market Overview

The global ethnic food market is undergoing a remarkable transformation as consumers across the world increasingly seek diverse culinary experiences beyond their traditional cuisines. Ethnic foods—ranging from Asian and Middle Eastern to Latin American and African cuisines—are no longer confined to specialty restaurants or cultural festivals. They are becoming mainstream, appearing on supermarket shelves, in fast-casual chains, and in frozen or ready-to-eat meal kits.

Get a Sample Now: https://www.towardsfnb.com/download-sample/5477

Market Dynamics

Drivers

- Cultural Globalization & Migration: Increasing movement of people across borders has expanded consumer exposure to diverse cuisines, creating demand for authentic ethnic foods.

- Consumer Curiosity and Culinary Exploration: Younger generations, especially Millennials and Gen Z, are adventurous eaters, eager to try global flavors and unique dishes.

- Rising Popularity of Plant-Based & Healthy Diets: Many ethnic cuisines naturally align with health-conscious eating, offering plant-forward, fermented, or minimally processed options.

- Convenience and Accessibility: The availability of ethnic food products through modern retail, online platforms, and ready-to-eat offerings has made it easier for consumers to enjoy global flavors at home.

Restraints

- Supply Chain Complexities: Importing specialty ingredients or preserving traditional preparation methods can pose challenges in mass production.

- Cultural Authenticity vs. Localization: Balancing authenticity with local taste preferences and regulatory compliance can be difficult for brands.

- High Production Costs: Premium ingredients, special packaging, and stringent quality control can increase costs, impacting price competitiveness.

Trends

- Fusion Cuisine: Mixing ethnic ingredients and techniques with local styles to create innovative dishes.

- Clean Labeling & Transparency: Demand for ingredient authenticity, origin traceability, and minimally processed food.

- Ready-to-Eat & Meal Kits: Growing popularity of microwavable ethnic meals and ethnic-themed meal kits for quick home preparation.

- Restaurant-Inspired Retail Products: Foodservice brands launching retail versions of their most popular ethnic dishes.

Market Growth Factors

- Urbanization and Exposure to Global Cultures

Urban areas act as melting pots of cultures, where people are more likely to encounter and adopt new cuisines, driving demand for ethnic food products.

- Increasing Travel and Culinary Tourism

International travel and exposure to foreign cuisines—physically or via food-focused content on platforms like YouTube, TikTok, or Netflix—boost consumer interest in ethnic dishes.

- Rise of Multicultural Populations

Countries with significant immigrant populations, such as the U.S., UK, Canada, and Australia, are experiencing increased demand for both authentic and fusion ethnic foods.

- Retail Expansion and Brand Innovation

Supermarkets, specialty food stores, and online marketplaces are increasingly offering ethnic food products, ranging from sauces and spices to frozen entrees and snacks.

Restraining Factors in the Ethnic Foods Market

Rising Consumer Demand for Natural Products Limits Growth of Preserved Food Items

Over the past two decades, consumer awareness and preference for all-natural food products have significantly increased. This growing demand poses a challenge for the ethnic foods market, particularly for products that require long-distance transportation and preservation.

Ethnic food items often involve international shipping, which necessitates the use of edible chemical preservatives to maintain product quality and shelf life. However, as consumers become more cautious about artificial additives and prioritize clean-label products, the use of such preservatives is increasingly scrutinized.

Additionally, since maritime shipping is the primary mode of global transport, the extended transit times make it difficult to rely solely on natural preservation methods. This creates a conflict between the need for long shelf life and the rising demand for natural, additive-free products. Small and local manufacturers may find it especially challenging to transition to natural preservation methods due to limited resources and infrastructure. To mitigate this issue, partnerships between local producers and globally established manufacturers could offer a solution by facilitating more localized production and distribution.

Market Opportunities

- Expansion into Mainstream Retail

Ethnic food brands can benefit by moving from niche or specialty stores into mainstream grocery retail chains, making products more accessible.

- Clean-Label and Organic Ethnic Foods

There is an emerging market for organic, non-GMO, gluten-free, and vegan ethnic food options that align with broader health and wellness trends.

- Private Label and Co-Branding

Retailers launching their own ethnic food lines or co-branding with local chefs and restaurants present opportunities for market penetration and product authenticity.

- Frozen and Ready-to-Eat Meal Innovation

The convenience trend opens doors for ethnic ready meals that are easy to prepare yet rich in authentic flavor appealing to busy, curious consumers.

Grab the Databook and Discover Key Industry Insights Instantly: https://www.towardsfnb.com/download-databook/5477

Recent Developments in the Ethnic Market

- June 2024:- DDC Enterprise Acquires Omsom:

DDC Enterprise, Ltd., a leading multi-brand Asian consumer food company, acquired Omsom, a fast-growing Asian food brand. The acquisition is set to accelerate Omsom’s product innovation by reducing R&D timelines by 50%. Additionally, the deal is expected to yield operational efficiencies and strengthen financial performance for both companies. - February 2023:- Omsom Expands to 550+ Target Stores Nationwide:

Omsom significantly expanded its retail footprint by launching in over 550 Target locations across the United States. This move effectively doubled the brand’s presence, enhancing nationwide visibility and accessibility to a broader consumer base. - July 2022:- Premier Foods Acquires The Spice Tailor:

Premier Foods acquired The Spice Tailor, an Indian meal kit company, for USD 57.1 million. This acquisition enhances Premier Foods’ global presence—particularly in the UK, India, Australia, Canada, and Ireland—and strengthens its ethnic foods portfolio, especially within the growing Australian market.

Top Companies Profiled in the Ethnic Foods Market:

- Ajinomoto Co. Inc. (Japan)

- Associated British Foods PLC (U.K.)

- McCormick & Company Inc. (U.S.)

- MTR Foods (India)

- Nestlé S.A. (Switzerland)

- General Mills (U.S.)

- Conagra Brands Inc. (U.S.)

- Tasty Bite Edibles Pvt. Ltd. (India)

- Taco Bell (U.S.)

- B&G Foods (U.S.)

Get detailed pricing and reports now : https://www.towardsfnb.com/price/5495

Segmentation Analysis

By Cuisine Type

- Asian (Chinese, Japanese, Thai, Korean, Indian)

- Middle Eastern & Mediterranean

- Latin American (Mexican, Brazilian, Peruvian)

- African

- European (Italian, Spanish, Greek, Eastern European)

- Others (Caribbean, Pacific Island, etc.)

By Product Type

- Sauces & Condiments

- Snacks & Savory Items

- Frozen Meals

- Meal Kits & Ready-to-Cook Items

- Canned & Preserved Foods

- Staples (Grains, Spices, Lentils, etc.)

By Distribution Channel

- Supermarkets & Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Retail/E-commerce

- Foodservice/Restaurants

Regional Insights

North America

- One of the largest markets, especially in the U.S. and Canada, due to diverse demographics and high demand for Latin American and Asian cuisines.

- Growing availability of ethnic foods in retail and quick-service chains.

- Fusion cuisine and meal kits gaining popularity.

Europe

- Significant growth in countries like the UK, Germany, and France, fueled by immigrant populations and culinary tourism.

- Mediterranean, Indian, and Middle Eastern foods dominate.

- Emphasis on authenticity and high-quality, natural ingredients.

Asia-Pacific

- Emerging and matured markets coexist: While countries like Japan and South Korea focus on niche international cuisines, India and China are exporting their cuisines globally.

- Cross-cultural culinary exchanges driving local consumption of foreign ethnic foods.

- Increasing popularity of Western, Middle Eastern, and Korean foods.

Latin America

- Strong domestic ethnic food culture, with growing export potential for cuisines like Mexican, Peruvian, and Brazilian.

- Urbanization and a growing middle class are leading to more diverse culinary preferences.

Middle East & Africa

- A blend of traditional ethnic food preferences and growing international exposure.

- Demand for imported ethnic foods is increasing in Gulf countries due to expatriate populations.

- South Africa emerging as a regional hub for ethnic food production and distribution.

Outlook and Future Opportunities

The ethnic food market is no longer a niche it’s a thriving global industry driven by diversity, curiosity, and convenience. As consumers around the world continue to explore new tastes and cultural experiences through food, the market offers exciting opportunities for both legacy brands and new entrants. The future belongs to companies that can deliver authentic, high-quality ethnic food products while staying responsive to health trends, convenience demands, and sustainability expectations.