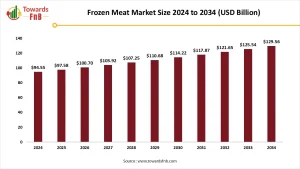

The global frozen meat market is currently valued at over USD 80 billion and is projected to reach USD 120+ billion by 2032, growing at a CAGR of 4.5-6%. The market includes raw, processed, and ready-to-cook frozen meat products that are sold through retail outlets, supermarkets, foodservice chains, and online platforms.

Frozen meat appeals to both consumers and businesses due to its longer shelf life, year-round availability, minimized waste, and consistent quality. The market has become especially critical in maintaining stable meat supplies during global disruptions such as pandemics, supply shocks, and fluctuating meat prices.

Market Overview

In a world where convenience, shelf-life, and global food security are top priorities, the frozen meat market has emerged as a vital pillar in the modern food supply chain. Offering extended preservation without compromising nutritional value, frozen meat is transforming how the world consumes animal protein.

From traditional retail to HoReCa (Hotels, Restaurants, and Catering), the demand for frozen meat spanning poultry, beef, pork, lamb, and specialty meats is scaling rapidly. With innovations in cold chain logistics, packaging, and international trade, the global frozen meat market is set to grow significantly in the coming decade.

Get a Sample Now: https://www.towardsfnb.com/download-sample/5477

Market Dynamics

Drivers

- Growing demand for convenient food options

- Urbanization and busy lifestyles

- Expansion of global cold chain infrastructure

- Rise in meat consumption in emerging economies

- Shift from fresh to frozen due to improved freezing tech

Challenges

- Concerns about meat quality degradation

- Consumer preference for fresh meat in certain regions

- Environmental impact of meat production and refrigeration

- Trade barriers and regulatory complexity

Trends

- Rise of organic and grass-fed frozen meats

- Growth of online meat delivery platforms

- Sustainable and recyclable packaging adoption

- Integration of AI/IoT in cold chain logistics

Market Growth Factors

- Rising Global Protein Demand

Increasing global populations and income levels especially in Asia and Africa are driving up meat consumption. Frozen meat helps bridge the gap between supply and demand, especially in regions with limited access to fresh meat.

- Cold Chain and Packaging Innovations

Advancements in freezing technologies such as individual quick freezing (IQF) and vacuum packaging have enhanced product integrity, taste retention, and safety making frozen meat more acceptable to a broader consumer base.

- Boom in E-Commerce and Food Delivery

Online meat retailers and food delivery apps have embraced frozen meat as a reliable and manageable inventory. Cold logistics, temperature-controlled vehicles, and last-mile delivery improvements are fueling this growth.

- Pandemic-Induced Behavioral Shifts

COVID-19 drastically reshaped food buying habits, leading to stockpiling, reduced market visits, and trust in hygienically frozen, packaged meats habits that continue post-pandemic.

Opportunities in the Frozen Meat Market

- Penetration into Developing Economies

Frozen meat’s affordability and year-round availability offer tremendous opportunity in regions with underdeveloped fresh meat infrastructure.

- Plant-Based Meat Hybrids

Some brands are developing frozen meat with blended animal and plant proteins, catering to flexitarians looking for balance between sustainability and nutrition.

- Private Label Expansion

Retailers are launching their own frozen meat brands, offering price-sensitive consumers attractive alternatives while increasing retailer margins.

- Health-Focused, Premium Cuts

Rising demand for leaner, high-quality meat (e.g., grass-fed beef, antibiotic-free chicken) in frozen formats is a niche with growing profitability.

Grab the Databook and Discover Key Industry Insights Instantly: https://www.towardsfnb.com/download-databook/5477

Recent Developments

- July 2024 :- Manna Tree Acquires Controlling Stake in VERDE Farms:

Manna Tree, a private equity firm focused on health and nutrition, announced its acquisition of a controlling stake in VERDE Farms, a leading provider of organic, 100% grass-fed beef. The investment aims to accelerate VERDE’s expansion within the rapidly growing “better-for-you” (BFY) beef segment, aligning with rising consumer demand for clean-label, sustainably sourced meat products. - June 2024 :- Tyson Foods Unveils New Frozen Chicken Offerings:

Tyson Foods introduced two new frozen products—Restaurant Style Crispy Wings and Honey Chicken Bites designed to deliver bold flavors and convenience. These high-protein offerings cater to consumers seeking premium, easy-to-prepare meals that replicate restaurant-quality experiences at home.

Top Frozen Meat Companies

The frozen meat market is dominated by several major players that collectively command a significant share of the global market and influence key industry trends. These companies are recognized for their extensive product portfolios, global distribution networks, and continuous investment in innovation, sustainability, and food safety.

- Kerry Group plc

- BRF Global

- Associated British Foods plc

- Tyson Foods, Inc.

- Pilgrim’s

- VERDE Farms

- Hewitt

Get detailed pricing and reports now : https://www.towardsfnb.com/price/5495

Segmentation Analysis

By Meat Type

- Poultry (chicken, turkey, duck) – Most consumed due to affordability and wide culinary usage.

- Beef – Popular in North America, Europe, and Latin America; often processed into patties, steaks, etc.

- Pork – High demand in Asia-Pacific and Europe; used in sausages, ribs, and belly cuts.

- Lamb & Goat – Niche segments with strong regional demand in Middle East, Africa, and South Asia.

- Other Meats (game, exotic, seafood blends) – Trending in gourmet and health-oriented products.

By Product Type

- Raw Frozen Meat

- Processed/Marinated Meat

- Ready-to-Cook/Ready-to-Eat Frozen Meals

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retailers

- Specialty Butcher Shops

- Foodservice/HoReCa

By End-Use

- Households (Retail Consumers)

- Commercial (Hotels, Restaurants, Catering)

- Industrial (Food Processing & Manufacturing)

Regional Insights

North America

- North America remains one of the largest consumers of frozen meat, supported by strong infrastructure, premium product demand, and well-established retail networks. The U.S. is also a major exporter of frozen beef and pork to Asia.

Europe

- Europe has a mature market with growing demand for organic and antibiotic-free frozen meat, especially in Germany, France, and the UK. Environmental awareness is pushing for sustainable packaging and traceable sourcing.

Asia Pacific

- The fastest-growing region, driven by rising middle-class incomes, rapid urbanization, and growing meat consumption in China, India, and Southeast Asia. Despite cultural preferences for fresh meat, the frozen format is gaining popularity due to affordability and convenience.

Latin America

- Brazil and Argentina are global leaders in meat production and are increasingly focusing on value-added frozen exports. Domestic markets are also warming up to frozen meat due to urban lifestyles and retail expansion.

Middle East & Africa (MEA)

- Frozen meat is vital in import-dependent Gulf countries, where local meat production is limited. Demand for halal-certified and premium frozen meat is rising across the UAE, Saudi Arabia, and North Africa.

Outlook and Future Opportunities

The frozen meat market is no longer just a solution for food preservation it is a fast-evolving industry that supports global food security, reduces waste, and meets rising demand for convenience and quality. As supply chains become more sophisticated and consumer habits evolve, the market is primed for continued growth.

Players who invest in cold chain logistics, sustainable practices, and innovative product development will thrive in this cold-but-hot market. Whether for households or high-volume foodservice, frozen meat is poised to be a cornerstone of modern food consumption.