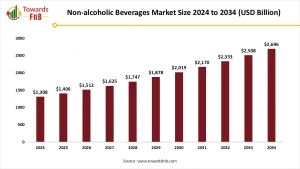

The Non-Alcoholic Beverages Market is witnessing remarkable growth, driven by health-conscious consumers, shifting lifestyles, and increasing demand for functional and innovative drinks. As of 2023, the global market was valued at approximately USD 1.3 trillion and is expected to reach USD 1.9 trillion by 2030, growing at a CAGR of 5.4% during the forecast period.

Market Overview

This expansive market includes carbonated soft drinks, bottled water, fruit juices, energy and sports drinks, tea, coffee, and dairy-based drinks. The surge in demand for sugar-free, low-calorie, and organic beverage options is redefining product development and marketing strategies in the industry.

Get a Sample Now: https://www.towardsfnb.com/download-sample/5477

Market Dynamics

- Changing Consumer Preferences

The shift from sugary carbonated drinks to healthier options like flavored water, herbal teas, and plant-based beverages is transforming the market landscape. Consumers now prioritize nutritional value, clean labels, and natural ingredients.

- Innovation & Functional Beverages

Brands are responding with a slew of functional beverages infused with vitamins, probiotics, and adaptogens aimed at improving gut health, immunity, and mental wellness.

- Premiumization Trend

There’s a growing consumer willingness to pay more for high-quality, artisanal, organic, and sustainably produced non-alcoholic beverages, fueling a new wave of premium products.

- E-commerce & DTC Models

Online channels and direct-to-consumer (DTC) platforms are revolutionizing beverage distribution, particularly in urban areas where convenience and digital access are top priorities.

Market Growth Factors

- Health & Wellness Movement

The global pivot toward wellness has led to an increased demand for beverages that support hydration, energy, weight management, and overall health.

- Rising Disposable Incomes

In emerging economies, rising middle-class incomes and urbanization are boosting the consumption of branded and premium non-alcoholic beverages.

- Urbanization and Fast-Paced Lifestyles

Ready-to-drink (RTD) options like iced teas, energy drinks, and bottled coffees are seeing a surge in demand from busy consumers looking for quick refreshment without compromising on health.

- Youth Demographics

Young consumers, especially Gen Z and millennials, are driving demand for trendy, ethically sourced, and Instagram-worthy beverage choices.

Opportunities in the Non-Alcoholic Beverages Market

- Plant-Based & Vegan Beverages

Almond milk, oat milk, soy beverages, and other plant-based drinks are fast becoming mainstream, offering new product development opportunities.

- Functional & Fortified Drinks

There’s growing room for innovation in immunity-boosting, energy-enhancing, and cognitive-support beverages, especially post-COVID.

- Sustainable Packaging

Eco-conscious consumers are rewarding brands that adopt recyclable, biodegradable, and reusable packaging. Sustainable practices are becoming a key differentiator.

- Untapped Rural Markets

In developing regions, increasing rural electrification and retail expansion are opening new avenues for non-alcoholic beverage sales.

Grab the Datebook and Discover Key Industry Insights Instantly: https://www.towardsfnb.com/download-databook/5477

Key Market Factors

- Regulatory Framework: Governments are enforcing labeling laws and sugar taxes, impacting product formulation and pricing.

- Supply Chain Efficiency: Timely sourcing of ingredients and maintaining cold chain logistics remain vital.

- Brand Loyalty & Visibility: Strong branding and digital engagement help companies build long-term customer relationships.

- Seasonality & Weather Patterns: Demand fluctuates seasonally, with peak sales during warmer months for certain categories.

Recent Developments

- September 2023 – Red Bull launched its first limited-edition Red Bull Winter Edition Spiced Pear in the UK. The release includes a full range of formats: 250ml, 250ml Price Marked Pack (PMP), and a 355ml Sugarfree variant. The drink blends pear flavor with a hint of cinnamon, offering a seasonal twist to its energy beverage lineup.

- July 2022 – PepsiCo, Inc. finalized an agreement to acquire land near Denver International Airport to construct a 1.2 million sq. ft. manufacturing facility. The project, supported by USD 1 billion from Denver’s Business Incentive Fund, is set to become PepsiCo’s largest soda manufacturing plant in the U.S.

- February 2022 – Nestlé introduced a plant-based version of Milo in Thailand. This ready-to-drink (RTD) soy-based beverage maintains Milo’s signature malt flavor while offering a nutritious, plant-based alternative.

- February 2022 – Jones Soda Co. entered into a partnership with The ICEE Company, a leading provider of frozen beverage treats, to roll out a series of new collaborative flavors, expanding its presence in the specialty beverage market.

Key Companies in the Non-Alcoholic Beverages Market:

- Nestlé S.A.

- PepsiCo, Inc.

- Unilever PLC

- Keurig Dr Pepper Inc.

- The Coca-Cola Company

- Jones Soda Co.

- Danone S.A.

- Suntory Beverage & Food Ltd.

- Asahi Group Holdings, Ltd.

- Red Bull GmbH

Segmentation Analysis

By Product Type

- Carbonated Soft Drinks: Declining slightly due to health concerns.

- Bottled Water: Fastest-growing due to health and hygiene awareness.

- Juices & Smoothies: Natural and organic variants gaining traction.

- Dairy & Plant-Based Drinks: Includes milk, yogurt drinks, and alternatives like soy, oat, and almond milk.

- Energy & Sports Drinks: Popular among athletes and fitness enthusiasts.

- Tea & Coffee: RTD variants seeing rising demand.

By Distribution Channel

- Supermarkets & Hypermarkets: Traditional retail stronghold with wide visibility.

- Convenience Stores: Popular for impulse buying and on-the-go consumption.

- Online Retail: Rapid growth with doorstep delivery and subscription models.

- Foodservice & Cafés: High-margin sales channel for premium and RTD beverages.

Regional Insights

North America

- A mature market with increasing focus on health and sustainability.

- Functional waters, kombucha, and zero-calorie sodas are trending.

Europe

- Strong demand for organic, low-sugar, and vegan drinks.

- Germany, UK, and France lead the charge with innovative product launches.

Asia-Pacific

- The fastest-growing market driven by urbanization, income growth, and dietary shifts.

- China and India show immense potential, particularly in bottled water and RTD tea/coffee.

Latin America

- Growth supported by youthful demographics and a rise in disposable income.

- Brazil and Mexico are key markets, especially for juices and energy drinks.

Middle East & Africa

- Emerging region with high bottled water consumption due to climate and hygiene concerns.

- UAE and South Africa are witnessing growing demand for wellness drinks.

Outlook and Future Opportunities

The Non-Alcoholic Beverages Market is no longer just about thirst quenchers—it’s now a battleground for health, innovation, and sustainability. As consumer expectations evolve, brands that stay agile, health-oriented, and eco-conscious will lead the way.

Whether it’s probiotic kombucha in the U.S., sugar-free juice blends in Europe, or herbal RTDs in Asia, the global beverage industry is embracing a non-alcoholic revolution—refreshing, diverse, and driven by purpose.