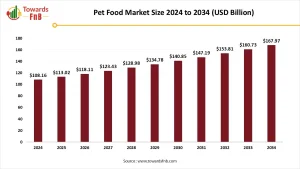

The global pet food market has witnessed significant growth over the past decade, driven by increasing pet ownership, rising disposable incomes, and a growing awareness of pet health and nutrition. In 2023, the market was valued at approximately USD 120 billion, with forecasts projecting a steady CAGR (Compound Annual Growth Rate) of around 5.5% from 2024 through 2034. By 2034, the market size is expected to surpass USD 210 billion, reflecting robust consumer demand worldwide.

Pets are increasingly considered family members, prompting owners to invest more in premium and specialized food products. The surge in pet adoption, urbanization, and the humanization of pets fuels demand for organic, natural, and functional pet food products tailored to meet specific dietary needs.

Market Overview

The pet food market encompasses a broad range of products designed to provide nutrition and health benefits to domesticated animals. These include dry kibble, wet/canned food, semi-moist meals, treats, and customized functional diets. Increasing awareness about animal well-being and changing consumer lifestyles have pushed pet food from a convenience purchase to a conscious investment in pet care.

Factors such as premiumization, sustainability, e-commerce growth, and innovation in pet food ingredients (like plant-based, insect protein, and grain-free formulas) are reshaping the market landscape.

Get a Sample Now: https://www.towardsfnb.com/download-sample/5477

Market Dynamics

According to the American Pet Products Association (APPA), total spending on pets in the U.S. reached USD 123.6 billion in 2021, covering pet food and treats, supplies, veterinary care, and other services. Pet food and treats accounted for the largest share, with sales hitting USD 50.0 billion that year.

Increasing health concerns among pets, such as joint diseases caused by lack of exercise and overfeeding, have become more prevalent. Conditions like high blood pressure and diabetes are also common among pets, prompting owners to prioritize nutritious diets. This growing awareness is driving pet owners to seek out healthier, high-quality pet food options, positively impacting the pet food market during the forecast period.

Osteoarthritis has notably risen among dogs and cats, with over 50% of these pets reportedly affected worldwide. While demand for pet food has surged in recent years, the market faces challenges. Large companies focus on producing premium-quality products, but the presence of cheaper, lower-quality alternatives by some manufacturers may restrain overall market growth in the coming years.

Key Market Insights

- 2024 Market Size: USD 125.44 billion

- Forecast (2034): USD 216.32 billion

- CAGR (2025–2034): 5.6%

- Dominant Product Type: Dry food continues to hold the largest share due to convenience and long shelf life.

- High-growth Segments: Organic, functional, and breed-specific pet food

- Key Trend: Pet humanization is fueling demand for premium, natural, and health-enhancing products.

Market Growth Drivers

- Rise in Pet Ownership

Increasing pet adoption, especially in urban households and among millennials, is a primary driver. During and after the COVID-19 pandemic, pet companionship became essential, further expanding the consumer base.

- Humanization of Pets

Consumers are treating pets like family, focusing on quality nutrition, variety, and dietary customization—mirroring trends in human food.

- Demand for Premium and Organic Pet Food

The growing popularity of grain-free, organic, high-protein, and raw food diets is transforming product innovation and premium positioning.

- E-commerce and Subscription Models

Online platforms have made pet food purchasing convenient, offering auto-deliveries, bulk discounts, and access to niche and premium brands.

- Focus on Pet Health and Functional Ingredients

Formulas targeting joint health, immunity, skin & coat, and digestive health are in high demand. Fortified pet food with vitamins, minerals, and probiotics is on the rise.

Market Opportunities in the Pet Food Market

- Plant-based and Alternative Proteins

The use of plant-based, insect-based, and lab-grown proteins provides sustainable alternatives to traditional meat-based pet food.

- Data-Driven Customization

Smart feeding devices and apps that collect pet data are allowing brands to offer personalized nutrition plans based on age, breed, weight, and health conditions.

- Functional & Therapeutic Diets

Veterinary-prescribed and wellness-oriented foods (for diabetes, obesity, allergies, etc.) present opportunities for pharmaceutical-nutrition collaborations.

- Expansion in Emerging Markets

The rise in middle-class income and pet adoption in regions like Asia-Pacific, Latin America, and the Middle East opens avenues for both mass and premium product lines.

- Sustainable Packaging & Sourcing

Eco-friendly packaging, ethical ingredient sourcing, and carbon-conscious supply chains are becoming consumer preferences, especially among Gen Z and millennial pet parents.

Grab the Databook and Discover Key Industry Insights Instantly: https://www.towardsfnb.com/download-databook/5477

Top Companies in the Pet Food Market

The pet food market is dominated by several major players who focus on innovation, product quality, and expanding their global reach through strategic partnerships, acquisitions, and product launches. Key companies in this sector include:

- Nestlé Purina PetCare

- Mars Petcare Inc.

- Hill’s Pet Nutrition

- General Mills

- Diamond Pet Foods

- J.M. Smucker

- United Petfood

- Simmons Pet Food

- Spectrum Brands / United Pet Group

- Unicharm Corp

Get detailed pricing and reports now : https://www.towardsfnb.com/price/5495

Segmentation Analysis

By Pet Type

- Dogs (Largest segment)

- Cats

- Birds

- Fish

- Others (rabbits, hamsters, reptiles)

By Product Type

- Dry Food (kibble)

- Wet/Canned Food

- Semi-moist Food

- Treats & Snacks

- Raw & Fresh Food

- Prescription/Veterinary Diets

By Ingredient Type

- Animal-based (chicken, beef, lamb, fish)

- Plant-based (peas, lentils, chickpeas)

- Insect-based

- Grains & grain-free variants

- Functional additives (probiotics, vitamins, omega-3s)

By Distribution Channel

- Supermarkets/Hypermarkets

- Pet Specialty Stores

- Veterinary Clinics

- Online Retail/E-commerce

- DTC (Direct-to-Consumer) Subscriptions

Regional Insights

North America

- Largest market, led by the U.S. with a market share of over 35% in 2024.

- Pet health insurance, veterinary care integration, and premium food trends are key contributors.

- Dominance of brands like Nestlé Purina, Hill’s, and Blue Buffalo.

Europe

- High awareness about pet welfare and sustainability.

- Regulatory pressure on labeling and ingredient sourcing.

- Popularity of organic and private-label pet food is growing.

Asia-Pacific

- Fastest-growing region, with a CAGR >6.5% forecasted.

- China, India, Japan, and South Korea are key markets due to rising urbanization and disposable incomes.

- Growing penetration of international and local brands via online platforms.

Latin America

- Brazil and Mexico lead in pet food sales.

- Rising pet care awareness and vet-prescribed diets contribute to regional demand.

- Growth of local and affordable brands meeting mass-market needs.

Middle East & Africa (MEA)

- Emerging market with rising pet ownership in urban centers.

- Import dependency offers opportunities for local manufacturing.

- Halal-certified and culturally adaptive pet food options are gaining traction.

Outlook and Future Opportunities

The pet food market is in the midst of a revolution driven by pet humanization, innovation, and health-conscious consumer behavior. Over the next decade, successful brands will be those that adapt to evolving nutritional science, embrace sustainability, personalize the pet experience, and leverage digital platforms for convenience and engagement.

From alternative proteins to data-driven personalization, the future of pet food is not only functional but also ethical, intelligent, and premium.