The global smoothie market is thriving as consumers across the world shift toward healthier lifestyles and prioritize convenient, nutrient-rich food choices. From breakfast boosters to post-workout fuels, smoothies have become a popular go-to option across age groups and demographics. This versatile beverage available in fruit-based, vegetable-based, dairy, and plant-based forms is transforming from a niche health food into a mainstream lifestyle product. With a projected CAGR of 6–8% through 2032, the smoothie market is riding the wave of health consciousness, functional nutrition, and personalized wellness.

Market Overview

Smoothies are thick, blended beverages typically made from fruits, vegetables, dairy or dairy alternatives, and often enhanced with superfoods, proteins, vitamins, or other supplements. The smoothie category spans ready-to-drink (RTD) bottled products, made-to-order fresh smoothies at cafés and restaurants, as well as do-it-yourself (DIY) home-blended options.

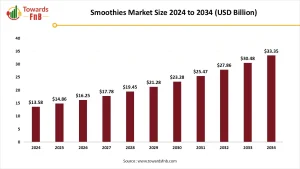

Today’s smoothie market is valued at over USD 12 billion and is expanding rapidly due to rising awareness of wellness trends, innovations in flavor combinations, and growth in plant-based and functional beverage categories.

Get a Sample Now: https://www.towardsfnb.com/download-sample/5477

Key Market Growth Factors

- Rising Health and Wellness Trends

Consumers are increasingly seeking healthier food and beverage choices that support immunity, energy, digestion, and overall wellness. Smoothies often packed with antioxidants, fiber, and essential nutrients fit perfectly within this lifestyle.

- Shift Toward Plant-Based Diets

As veganism, vegetarianism, and flexitarian diets grow globally, the demand for plant-based smoothies using almond milk, oat milk, coconut milk, or soy is surging. These variants appeal to lactose-intolerant, health-conscious, and sustainability-focused consumers.

- Convenience and On-the-Go Lifestyles

Busy schedules are prompting consumers to seek quick yet nutritious options. Smoothies offer a balanced meal or snack that is portable, easy to consume, and often tailored to dietary preferences or fitness goals.

- Innovation and Functional Ingredients

The incorporation of superfoods (like spirulina, chia seeds, acai, turmeric), protein powders, collagen, and probiotics is driving demand among fitness and health enthusiasts. Brands are continually innovating to offer specialized smoothies for immunity, weight loss, muscle recovery, and gut health.

- Expanding Distribution Channels

The growth of e-commerce, subscription services, and direct-to-consumer delivery is helping both established brands and startups tap into a global audience. Retail visibility through supermarkets, convenience stores, smoothie bars, and cafés is also increasing accessibility.

Market Opportunities in the Smoothie Market

- Personalized Nutrition

There’s rising demand for smoothies tailored to individual dietary needs, such as low-sugar, keto-friendly, gluten-free, or allergen-free blends. Brands that offer customization are gaining a competitive edge.

- Clean Label and Organic Products

Consumers are increasingly seeking clean-label products with no artificial preservatives, colors, or sweeteners. Organic and non-GMO certifications add value, especially in developed markets.

- Sustainability and Eco-Friendly Packaging

Sustainable sourcing and packaging innovations such as recyclable bottles, compostable straws, and minimal-waste delivery models are attracting environmentally aware consumers.

- Emerging Markets Expansion

Rising urbanization and health awareness in Asia-Pacific, the Middle East, and Latin America present untapped potential for smoothie brands, particularly affordable RTD options and locally inspired flavors.

Grab the Databook and Discover Key Industry Insights Instantly: https://www.towardsfnb.com/download-databook/5477

Latest News and Developments:

- January 2025 :- Daily Harvest Launches High-Protein Smoothies:

Daily Harvest introduced a new line of high-protein smoothies containing 20g of plant-based protein per serving. These allergen-free, organic products are available online and at Kroger stores. In collaboration with tennis star Sloane Stephens, the launch features flavors such as Dark Chocolate, Vanilla Bean, and Mixed Berry, priced at USD 8.99 per cup. - January 2025 :- Odwalla Relaunches Under Grupo Jumex:

Backed by Grupo Jumex, Odwalla returned to the market with a refreshed range of smoothies (Mango, Strawberry-Banana, and Berries) and juices (Orange, Guava-Ginger, Green Juice, and Orange). Offered in 13.9-oz glass bottles and Tetra Prisma cartons, the brand continues to focus on health, quality, and sustainability, in line with Jumex’s six-decade legacy in beverages. - June 2024 :- Froosh Debuts Eco-Friendly Smoothies:

Froosh launched 750ml smoothies in lightweight cardboard packaging, cutting carbon emissions by 82% and packaging weight by 91% compared to traditional glass bottles. Made with 100% fruit and no added sugars, the new line is now available across Finland, the Nordics, the Baltics, and other regions. This initiative supports Fazer’s commitment to reducing CO₂ emissions by 42% by 2030. - May 2024 :- REBBL Introduces Smoothie Starter Line:

REBBL unveiled its Smoothie Starter, a multi-serve organic base designed for creating high-protein, gut-health-focused smoothies. Available in Coconut and Oat Milk varieties, each serving offers 20g of plant protein and postbiotics. Sold at Target and Sprouts for USD 9.99, the product aims to simplify smoothie preparation while delivering functional nutrition and immunity support. - May 2024 :- Delice de France Partners with Batch for Quick-Serve Smoothies:

Delice de France launched a new range of smoothies and shakes in collaboration with Batch, offering preparation in just 30 seconds using apple juice or milk. Flavors include Super Green, Mango & Dragon Fruit, and Vanilla Matcha. Gluten-free and vegan, these beverages are designed for retailers looking to provide fast, nutritious drink options.

Top Companies in the Smoothie Market

The global smoothie market is highly competitive, featuring a diverse mix of players ranging from multinational beverage corporations to niche health-focused brands. Key competitive strategies revolve around product innovation particularly the introduction of functional ingredients, plant-based formulations, and organic options to appeal to health-conscious consumers.

The Ready-to-Drink (RTD) segment is witnessing significant growth, driven by consumer demand for convenience and products with extended shelf life, made possible by advanced processing technologies. Environmental and ethical considerations are also shaping competition, with brands increasingly adopting eco-friendly packaging and sustainable sourcing practices as major differentiators. Direct-to-consumer (DTC) and e-commerce channels are expanding rapidly, enabling greater consumer access and brand interaction. In addition, competitive dynamics are being influenced by targeted marketing campaigns, strategic pricing, and partnerships with retailers and food service providers.

The report offers an in-depth analysis of the competitive landscape, featuring detailed profiles of leading companies in the smoothies market, including:

- Smoothie King

- Maui Wowi Hawaiian Coffees & Smoothies

- Suja Juice

- Innocent Drinks

- Bolthouse Farms

- Jamba Juice Company

- Ella’s Kitchen Ltd

- Barfresh Food Group, Inc.

- Tropical Smoothie Cafe

Get detailed pricing and reports now : https://www.towardsfnb.com/price/5495

Segmentation Analysis

By Product Type

- Fruit-Based Smoothies

The most common segment, using tropical, berry, and citrus fruits. Often blended with juice or dairy alternatives. - Vegetable-Based Smoothies

Includes green smoothies made with spinach, kale, avocado, cucumber, and celery. Growing rapidly due to detox and diet trends. - Dairy-Based Smoothies

Made with yogurt, milk, or whey protein, appealing to those seeking creamier textures and protein content. - Functional/Protein Smoothies

Enriched with protein, adaptogens, superfoods, or supplements targeting specific health outcomes (e.g., energy, muscle gain).

By Distribution Channel

- Supermarkets/Hypermarkets

Lead in volume sales for bottled smoothies with wide product variety. - Smoothie Bars & Cafés

Offer fresh, customizable options. Key growth segment in urban areas. - Online Retail & Subscription Services

Ideal for functional and niche health smoothie brands. Rising due to convenience and home-delivery demand. - Convenience Stores

Ready-to-drink options for on-the-go consumption. - Fitness Centers & Healthcare Institutions

Smoothies offered as meal replacements or post-workout nutrition.

Regional Insights

North America

- North America holds the largest market share, led by the U.S., where smoothies are widely consumed as breakfast alternatives, gym supplements, and meal replacements. The demand for organic, functional, and low-sugar options is strong.

Europe

- Europe is seeing a growing preference for natural and clean-label smoothies, especially in the UK, Germany, France, and Scandinavia. Consumers in this region value health claims and sustainability, driving interest in ethical and transparent smoothie brands.

Asia Pacific

- The fastest-growing region, powered by rising disposable incomes, urban lifestyles, and growing awareness of wellness trends in countries like China, India, Japan, and Australia. Tropical fruit blends and low-calorie smoothies are gaining popularity.

Latin America

- Smoothies are gaining ground as a healthier alternative to sugary drinks. Brazil, Mexico, and Argentina are key markets, with abundant local fruit varieties and rising health-consciousness.

Middle East and Africa (MEA)

- An emerging market with increasing demand in the UAE, Saudi Arabia, and South Africa. Expanding retail infrastructure and youth-focused marketing are driving growth in premium smoothie products.

Outlook and Future Opportunities

The global smoothie market is well-blended with innovation, health consciousness, and consumer-centric customization. As more people worldwide focus on proactive health management and convenient nutrition, smoothies are evolving into personalized, functional lifestyle products.

Companies that embrace clean labels, cater to plant-based trends, and innovate with exotic flavors or targeted health benefits will be best positioned to lead the next wave of growth. Whether in a bottle, at a café, or from a home blender, smoothies are here to stay and their market is just getting started.