Europe Protein Market Growth, Opportunities, and Segmentation

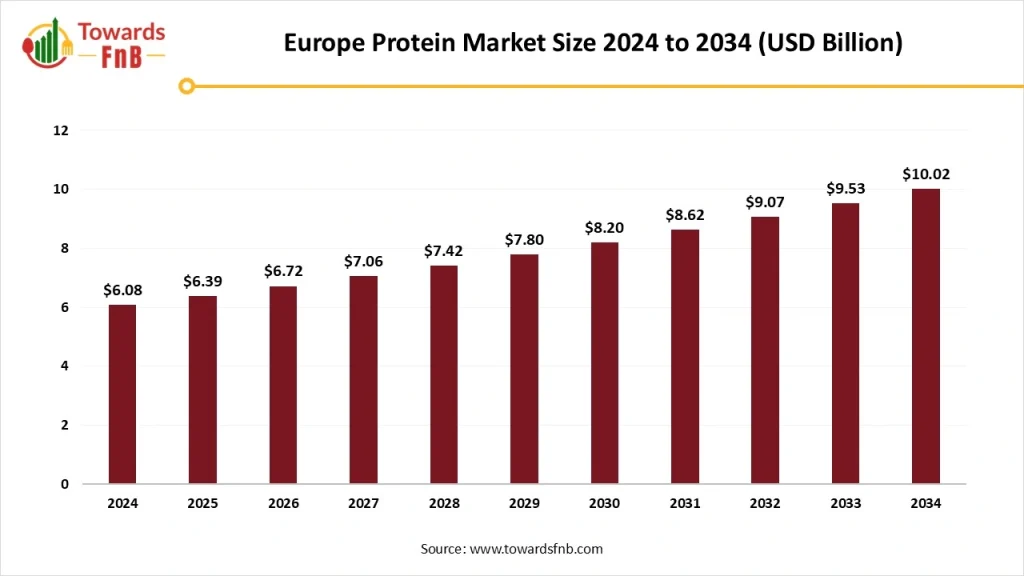

The Europe protein market size is projected to expand from USD 6.39 billion in 2025 to USD 10.02 billion by 2034, growing at a CAGR of 5.12% during the forecast period from 2025 to 2034.

The market is driven by rising health consciousness, increasing demand for high-protein diets, growing sports and fitness participation, and the expanding use of protein ingredients in functional foods, beverages, and dietary supplements. Additionally, the shift toward plant-based proteins and clean-label products is further fueling growth in the European protein industry.

Europe Protein Market Overview

Protein is an essential nutrient that plays a crucial role in the body’s growth, repair, and maintenance of tissues. The protein market in Europe spans a wide range of applications, including human nutrition, animal feed, sports and fitness, and functional foods. It is largely driven by the growing consumer awareness around health and wellness, and the increasing popularity of protein-rich diets.

In Europe, protein sources are diversifying beyond the traditional animal-based options to incorporate plant-based and novel protein types, driven by sustainability concerns and the rise of vegetarian and vegan diets. Innovations in the food industry, such as alternative proteins derived from insects, algae, and lab-grown meat, are gaining traction and contributing to the market’s growth.

The regulatory landscape in Europe has also become more favorable to innovation in protein products. The European Union has established various frameworks to regulate novel foods, creating opportunities for companies in the plant-based and alternative protein sectors to enter the market. Furthermore, the increasing emphasis on sustainability in food production is accelerating the shift from animal-based proteins to more sustainable sources.

Curious About Our Insights? Download a Sample Report for Free! https://www.towardsfnb.com/download-sample/5751

Market Growth Factors

Several key factors are driving the growth of the protein market in Europe:

- Health and Wellness Trends:

As consumers become more health-conscious, the demand for protein-rich foods is increasing. Protein is often associated with benefits such as muscle growth, weight management, and improved metabolism, which makes it a key ingredient in sports nutrition, fitness supplements, and functional foods. - Plant-Based Protein Demand:

The growing trend toward plant-based diets is one of the main drivers for the Europe protein market. With more individuals adopting vegetarian, vegan, and flexitarian diets, the demand for plant-based protein alternatives has soared. These include products like plant-based burgers, dairy alternatives, protein powders, and protein bars made from sources like peas, soy, and lentils. - Technological Advancements:

The innovation and development of alternative protein sources, such as cultured meat, insect-based proteins, and algae-based proteins, are significantly reshaping the European protein market. These technologies not only cater to the growing demand for sustainable protein but also offer unique solutions that align with environmental and ethical concerns. - Sustainability and Environmental Concerns:

Sustainability has become a top priority in Europe, especially in the food industry. With the environmental impact of livestock farming being a significant concern, there is a strong push toward reducing dependence on animal-based proteins and shifting towards more eco-friendly alternatives. This is driving investments in research and development of alternative protein sources that have lower carbon footprints. - Regulatory Support:

In Europe, regulatory frameworks around novel foods have become more structured, making it easier for companies to introduce innovative protein solutions into the market. The European Food Safety Authority (EFSA) has provided clear guidelines for assessing new protein sources, further stimulating growth in this sector.

Europe Protein Market Trends

- Rise of Plant-Based Proteins: Consumer shift toward plant-based diets is accelerating demand for soy, pea, and rice protein across food and beverage segments.

- Clean-Label and Transparent Products: European consumers prefer protein products with minimal processing, organic certification, and clear ingredient sourcing.

- Innovation in Functional Foods: Companies are launching protein-fortified snacks, bakery items, and dairy alternatives that offer both taste and health benefits.

- Focus on Sustainability: Ethical sourcing, reduced carbon footprints, and sustainable packaging are influencing brand choices in the protein segment.

Quickly access key insights with our streamlined Table of Contents: https://www.towardsfnb.com/table-of-content/europe-protein-market

Europe’s Protein Surge Why Your Diet (and the Planet) Will Never Be the Same

Europe is at the forefront of a protein revolution one that’s not just changing diets, but also transforming how food is produced, marketed, and consumed. With growing demand for clean, ethical, and sustainable nutrition, the shift toward high-protein diets is reshaping the future of food.

What’s Driving the Surge?

Consumers are more informed than ever. Health concerns, rising lifestyle diseases, and interest in preventive nutrition are fueling protein consumption. At the same time, a growing number of Europeans are adopting flexitarian, vegetarian, or vegan diets, putting alternative proteins in the spotlight.

The Environmental Factor

Animal agriculture is under scrutiny for its environmental footprint. In response, plant-based and alternative proteins are being embraced not only for health benefits but also for their potential to reduce greenhouse gas emissions, land use, and water consumption.

What It Means for You?

Whether you’re an athlete, a busy professional, or simply trying to eat better, the market now offers more protein-rich options than ever from shakes and bars to pasta and yogurts. You’re also supporting a shift toward a more sustainable global food system.

Green Growth The Rise and Rise of Plant-Based Protein in Europe

From supermarket shelves to restaurant menus, plant-based proteins are everywhere in Europe. With a growing preference for ethical, health-friendly food, plant-based options are no longer niche they’re mainstream.

Why It’s Gaining Ground

Consumer awareness about the health risks associated with excessive red meat consumption has been a key driver. Soy, pea, and rice proteins are emerging as key ingredients in everything from burgers to protein drinks, and they come with a smaller environmental impact.

Innovation Is Everywhere

Brands are using fermentation tech, improved flavor engineering, and even AI to create better-tasting, texture-rich alternatives. Products like oat protein milk, lentil-based snacks, and hybrid meat are setting a new standard in nutrition.

Policy Backing the Movement

The EU is supporting plant-based food innovation through funding and research. Clearer labeling laws and nutrition guidelines are also helping consumers make informed, healthier choices.

Europe’s Protein Boom: More Choices, Better for You

Europe’s protein market is booming, and with it comes a wide array of choices for health-conscious consumers. Whether animal-based or plant-derived, protein products are becoming essential in everyday diets.

What’s Changing?

Traditional protein powders and meat products now share shelf space with chickpea pasta, algae protein smoothies, and insect-based protein bars. Consumers want function and flavor, and brands are delivering both.

For Everyone, Everywhere

From gym-goers looking for muscle recovery to seniors wanting better bone health, there’s a protein solution tailored to every life stage and lifestyle. Convenience also plays a big role—on-the-go formats like ready-to-drink shakes and bars are becoming daily staples.

The Market Impact

With the market expected to grow from USD 6.39 billion in 2025 to USD 10.02 billion by 2034, there’s a clear demand trend. Brands investing in transparency, sustainability, and innovation are likely to lead the pack in the coming decade.

Get Full Pricing and Customized Report Options Here: https://www.towardsfnb.com/price/5751

Case Study: My Protein’s Market Leadership

UK-based brand My Protein has emerged as a frontrunner in Europe’s protein supplement space. With a robust online presence and a broad range of flavored protein powders, ready-to-drink shakes, and snacks, the brand has successfully tapped into the needs of both gym-goers and everyday consumers. Strategic localization of products, investment in influencer marketing, and transparent labeling have played a key role in their regional dominance.

Read More:https://www.foodbeveragestrategies.com/gluten-free-food-market/

Europe Protein Market Key Players

- Arla Foods Ingredients Group

- Glanbia Nutritionals

- FrieslandCampina Ingredients

- Kerry Group

- Cargill Inc.

- ADM (Archer Daniels Midland)

- Ingredion Incorporated

- Roquette Frères

- Südzucker Group (BENEO)

- Tereos Group

- Corbion N.V.

- Royal DSM

- DuPont (IFF Nutrition & Biosciences)

- MycoTechnology

- Meatless Farm Co.

- Novozymes A/S (alternative protein enzymes)

Market Dynamics

Drivers

Health consciousness, rising prevalence of lifestyle-related conditions, and an increase in vegetarian and flexitarian diets are primary drivers propelling market growth. In addition, government initiatives promoting nutritional education and clean eating further reinforce consumer preference for high-protein diets.

Opportunities

There is immense potential in protein-enriched ready-to-eat meals and snacks, particularly among busy urban consumers. Emerging trends such as insect protein and fermented proteins present new frontiers for R&D. E-commerce platforms also offer protein brands expanded reach and direct engagement with health-focused consumers.

Challenges

Despite growth, the market faces challenges such as high production costs for alternative proteins, regulatory complexities, and taste or texture barriers that may limit consumer adoption. Additionally, competition among plant-based protein formats could lead to market saturation without clear differentiation.

Segmentation Analysis

The Europe protein market can be segmented based on source, form, application, and distribution channel. Let’s explore these segments:

By Source

- Animal-based Proteins: This includes proteins derived from meat, dairy, and eggs. Despite the growing popularity of plant-based proteins, animal-based proteins still dominate the market due to their higher protein content and established consumer demand.

- Plant-based Proteins: With the rise of veganism and flexitarian diets, plant-based proteins such as soy, pea, rice, and hemp are becoming increasingly popular in Europe. They are often used in meat alternatives, dairy-free products, and protein supplements.

- Novel Proteins: Proteins derived from insects, algae, and lab-grown meat are gaining attention for their sustainability and nutritional benefits. These novel protein sources are anticipated to grow significantly in the coming years.

By Form

- Powder: Protein powders are widely used in sports nutrition, meal replacement shakes, and functional foods. This form holds a significant market share due to its versatility and ease of consumption.

- Bars: Protein bars are growing in popularity as a convenient on-the-go protein source, especially among busy professionals and athletes.

- Ready-to-Drink (RTD): RTD protein beverages are seeing increasing demand as a convenient and quick protein source, especially among fitness enthusiasts.

By Application

- Food and Beverages: This includes protein-enriched foods and drinks like snacks, energy bars, beverages, and ready-to-eat meals. The health and wellness trend is driving the growth of protein-fortified foods.

- Animal Feed: Proteins are also used in the production of animal feed, which remains a significant segment due to the growing demand for animal-based food products in Europe.

- Pharmaceuticals: Protein-based drugs and supplements for medical purposes, including weight management and muscle repair, are gaining traction in the healthcare market.

By Distribution Channel

- Online Retail: E-commerce platforms are becoming a key distribution channel, particularly in light of the growing trend of direct-to-consumer (DTC) sales. Online sales of protein supplements and foods are expected to rise.

- Supermarkets and Hypermarkets: Traditional retail outlets like supermarkets and hypermarkets remain dominant in the distribution of protein products, especially for everyday food and beverages.

- Specialty Stores: Health food stores and fitness nutrition outlets are significant for protein products aimed at the fitness and wellness segment.

Regional Insights

The Europe protein market is experiencing varied growth across different regions:

- Western Europe:

Countries like the UK, Germany, France, and Italy are leading the protein market in Europe. These countries have a strong consumer base for both animal-based and plant-based protein products, with an increasing demand for plant-based foods and beverages. - Northern Europe:

Northern European countries like Sweden, Denmark, and Finland have seen rapid adoption of plant-based protein products, as sustainability concerns are particularly strong in this region. The demand for alternative proteins such as algae and insect proteins is higher here compared to other regions. - Southern Europe:

In countries like Spain and Greece, the protein market is growing steadily, with traditional animal-based proteins still dominating the market. However, plant-based protein products are making inroads, especially in urban areas where health and wellness trends are becoming more pronounced. - Eastern Europe:

The market for protein in Eastern Europe is still emerging, with traditional animal-based proteins being more dominant. However, there is an increasing shift toward plant-based alternatives as consumer awareness about health and sustainability grows.

Unlock Personalized Insights | Schedule a Meeting with Our Experts Today! https://www.towardsfnb.com/schedule-meeting

Future Outlook

The Europe protein market is poised for significant growth in the coming years, driven by factors such as health and wellness trends, technological advancements, sustainability concerns, and evolving consumer preferences. The rise of plant-based and alternative protein sources offers exciting opportunities for innovation, while the growing demand for protein in the sports and fitness segment adds further momentum to the market. Companies that can adapt to these trends and capitalize on emerging segments like alternative proteins and personalized nutrition are well-positioned to succeed in this dynamic market.

With the market expected to reach nearly USD 10.02 billion by 2034, the future looks bright for the Europe protein market, offering vast opportunities across different product categories and regions.