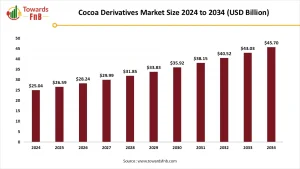

The global cocoa derivative market was valued at approximately USD 14.6 billion in 2024, and it is projected to reach nearly USD 23.1 billion by 2034, expanding at a CAGR of 4.8% during the forecast period from 2025 to 2034. This growth is a reflection of both increasing product applications and the surge in premium, ethically sourced cocoa demand

Market Overview

The global cocoa derivative market has witnessed significant expansion in recent years, driven by rising demand for chocolate-based products, increasing consumer inclination toward functional food, and the evolving use of cocoa in cosmetics and pharmaceuticals. Cocoa derivatives including cocoa butter, cocoa powder, and cocoa liquor are extracted from cocoa beans and serve as essential ingredients across diverse industries such as food & beverage, confectionery, personal care, and health supplements.

Get a Sample Now: https://www.towardsfnb.com/download-sample/5477

Market Growth Factors

- Rising Demand for Confectionery and Functional Foods

The confectionery industry remains the largest consumer of cocoa derivatives. As urbanization and income levels rise, particularly in emerging markets, consumer preferences are shifting toward indulgent and premium chocolate products. Additionally, cocoa’s antioxidant-rich profile is increasingly appealing to health-conscious consumers, leading to its incorporation in functional foods, nutritional bars, and beverages.

- Health Benefits of Cocoa

Cocoa derivatives contain polyphenols and flavonoids, known for their cardiovascular health, anti-inflammatory, and antioxidant properties. This has catalyzed their adoption in nutraceuticals and functional health beverages.

- Ethical and Sustainable Sourcing Trends

The market has seen a marked increase in demand for Fairtrade, Rainforest Alliance-certified, and organic cocoa derivatives. Brands leveraging transparent supply chains and sustainable sourcing practices are achieving stronger customer loyalty and competitive advantage.

- Innovation in Personal Care Products

Cocoa butter’s emollient properties make it a valued ingredient in skincare products. With the surge in demand for natural and plant-based cosmetics, manufacturers are introducing cocoa-based creams, balms, and lotions targeting the vegan and organic product segments.

Opportunities in the Cocoa Derivative Market

- Expansion in Plant-Based and Vegan Categories

With plant-based diets gaining global traction, cocoa derivatives especially cocoa butter and powder—are being utilized as dairy butter alternatives in vegan desserts, ice creams, and spreads. This growing demographic offers untapped potential for product innovation.

- Emerging Economies as New Growth Frontiers

Countries in Asia Pacific, Latin America, and parts of Africa are witnessing an upsurge in chocolate consumption due to rising disposable incomes and Western influence. These markets are poised to become major revenue contributors over the next decade.

- Product Development and R&D

There’s significant scope in creating low-sugar, organic, or fortified cocoa-based products. Technological advancements in cocoa processing like fermentation enhancements and flavor optimization are opening new pathways for value-added derivatives.

Grab the Databook and Discover Key Industry Insights Instantly: https://www.towardsfnb.com/download-databook/5477

Cocoa Derivatives Market Report Highlights

- Cocoa Powder Dominates the Market: The cocoa powder segment accounted for the largest market share, driven by its versatile flavor profile and extensive use in the confectionery and bakery sectors.

- Personal Care Segment to Witness Fastest Growth: The personal care application segment is expected to grow at the highest rate due to increasing incorporation of cocoa derivatives in cosmetic and skincare products.

- Asia Pacific to Experience Rapid Expansion: The Asia Pacific region is anticipated to grow significantly, fueled by a rising middle-class population with increasing disposable income and growing demand for premium food and personal care products.

- Leading Market Players: Prominent companies operating in the cocoa derivatives market include Olam Group, Cargill, Natra, JB Foods, Ecuakao Group, United Cocoa Processor, Indcre, and Barry Callebaut.

Top Companies & Market Share Insights in Cocoa Derivatives Market

The cocoa derivatives market is moderately consolidated, with several global and regional players contributing to its growth. Major companies such as Olam Group Ltd., Cargill Inc., Barry Callebaut AG, JB Foods Ltd., and Ecuakao Group Ltd. hold significant market shares due to their strong global distribution networks, product innovation, and extensive manufacturing capabilities.

Barry Callebaut AG has a robust global footprint, operating in nearly 160 countries. The company is a key player in providing a wide range of cocoa and chocolate products to food manufacturers and artisanal users worldwide. Ecuakao Group Ltd. offers a diverse portfolio that includes cocoa liquor, natural cocoa powder, cocoa beans, and cocoa mass/liquor, catering to both industrial and specialty markets.

Top Cocoa Derivatives Companies Include:

- Olam Group Ltd.

- Cargill Inc.

- Natra SA

- JB Foods Ltd.

- Ecuakao Group Ltd.

- United Cocoa Processor Inc.

- Indcre S.A.

- Barry Callebaut AG

- Moner Cocoa SA

- Altinmarka Gida ve Tic AS

Get detailed pricing and reports now : https://www.towardsfnb.com/price/5495

Segmentation Analysis

By Type

- Cocoa Butter: Widely used in food, cosmetics, and pharmaceuticals due to its smooth texture and stability.

- Cocoa Powder: A staple in beverages, baked goods, and desserts.

- Cocoa Liquor (Mass): Integral in chocolate production, combining both butter and solids.

- Others: Include cocoa nibs, shells, and extracts used in niche health and culinary applications.

By Application

- Food & Beverage: Confectionery, bakery, dairy alternatives, beverages.

- Cosmetics & Personal Care: Skin creams, lip balms, soaps, lotions.

- Pharmaceuticals: Medicinal syrups, capsules, dietary supplements.

- Others: Pet food, aromatherapy products.

By Distribution Channel

- Business-to-Business (B2B): Ingredients sold to food manufacturers, cosmetics companies, and pharma firms.

- Retail (B2C): Direct sales through supermarkets, health stores, online platforms, and specialty stores.

Regional Insights

- North America

The region holds a substantial market share owing to high per capita chocolate consumption and the dominance of multinational food and cosmetic brands. The U.S. leads the charge with a growing inclination toward Fairtrade-certified cocoa products.

- Europe

Europe is a mature market, particularly strong in countries like Germany, Switzerland, Belgium, and the U.K. The region’s well-established confectionery industry and emphasis on sustainability in cocoa sourcing continue to drive market growth.

- Asia Pacific

Asia Pacific is expected to witness the fastest growth through 2034, especially in China, India, Japan, and Indonesia. Increasing urbanization, rising disposable income, and growing interest in Western-style confections are primary drivers.

- Latin America

As both a producer and emerging consumer, Latin America especially Brazil, Ecuador, and Colombia is experiencing a dual impact. Investments in value-added cocoa processing are on the rise to cater to domestic and export markets.

- Middle East & Africa

Africa, led by countries like Ivory Coast and Ghana, dominates the global cocoa production landscape. However, the region is also showing potential for domestic cocoa derivative consumption as incomes rise and processing infrastructure improves.

Outlook and Future Opportunities

The global cocoa derivative market is poised for sustained growth, bolstered by dynamic demand across confectionery, cosmetics, and health-oriented industries. As consumers seek premium, ethically sourced, and functional products, businesses that prioritize innovation, sustainability, and value chain integration are well-positioned to lead. The convergence of health trends, clean-label demand, and evolving food science will continue to unlock opportunities for cocoa derivatives on a global scale.