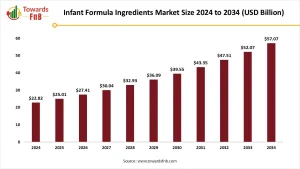

As modern parenting increasingly aligns with science-backed nutrition and convenience, the global infant formula ingredient market has witnessed rapid expansion. The market is playing a vital role in addressing the nutritional needs of infants when breastfeeding is not feasible or is supplemented.

Driven by rising birth rates in emerging economies, increasing awareness of infant health, and technological advancements in nutritional science, this market continues to grow steadily across multiple regions.

Market Overview

Infant formula ingredients are essential components used in the production of formula milk for babies aged 0–24 months. These ingredients are designed to replicate the nutritional composition of breast milk as closely as possible, offering infants vital macronutrients and micronutrients for healthy growth and development.

Manufacturers typically use ingredients such as proteins, fats, carbohydrates, vitamins, minerals, prebiotics, and probiotics in varying formulations to meet the needs of different age groups and specific health conditions (e.g., lactose intolerance, underweight, or allergies).

The demand for premium and specialty infant formulas is on the rise, with a particular focus on organic, clean-label, and functional ingredients.

Get a Sample Now: https://www.towardsfnb.com/download-sample/5477

Key Market Growth Factors

- Rising Global Birth Rates and Working Mothers

Countries across Asia, Africa, and Latin America are witnessing an uptick in population growth, fueling the need for infant nutrition solutions. Additionally, more women are returning to the workforce soon after childbirth, leading to a higher dependency on infant formula as an alternative or supplement to breastfeeding.

- Innovations in Nutritional Science

Significant progress in understanding infant gut microbiota, immune system development, and brain health is guiding manufacturers toward more sophisticated, science-backed formulations. Prebiotics, probiotics, and omega-3 fatty acids (DHA/ARA) are increasingly added to improve digestive and cognitive development.

- Increasing Demand for Organic and Hypoallergenic Formulas

Parents are becoming highly selective about what goes into their child’s diet. This has resulted in a surge in demand for organic, non-GMO, and hypoallergenic ingredients that reduce the risk of allergens, synthetic additives, and genetically modified substances.

- Expansion of Online Retail and Convenience Packaging

E-commerce platforms and DTC (direct-to-consumer) sales models are transforming the way infant nutrition products reach parents. Coupled with innovations in ready-to-feed packaging, these trends are accelerating market penetration, especially in urban areas.

Opportunities in the Infant Formula Ingredient Market

- Plant-Based and Vegan Infant Formula Ingredients: Driven by rising ethical consumerism, plant-based ingredients like soy protein, almond milk bases, and oat-derived prebiotics are gaining attention.

- Fortified Formulations: There is strong demand for ingredients enriched with iron, zinc, choline, lutein, and nucleotides to support growth, vision, and immune function.

- Region-Specific Formulas: Brands have an opportunity to develop culturally tailored or region-specific infant formula ingredients based on dietary preferences, availability of raw materials, and regulatory guidance.

- Sustainability and Clean Label: Natural sourcing, eco-friendly processing, and transparency in ingredient origin can act as major differentiators for manufacturers.

Grab the Databook and Discover Key Industry Insights Instantly: https://www.towardsfnb.com/download-databook/5477

Recent Developments

- May 2023 – Arla Foods Ingredients introduced Lacprodan® Alpha-50, an infant formula ingredient rich in alpha-lactalbumin. This launch addresses the rising demand for low-protein formulations in infant nutrition.

- April 2023 – Danone Manifesto Ventures, the investment arm of Danone SA, committed approximately USD 2 million to Israeli startup Wilk. The funding aims to accelerate the development of cell-based breast milk components for next-generation infant formulas.

- March 2023 – Danone North America launched Pepticate, a hypoallergenic baby formula in the U.S. market. Designed to alleviate cow’s milk allergy (CMA) symptoms in infants aged 0–12 months, this extensively hydrolyzed formula arrives amid an ongoing infant formula shortage in the country. Pepticate is already a trusted product in European markets.

Infant Formula Ingredients Market Challenges

The growth of the infant formula ingredients market faces several obstacles, particularly in low-income regions where awareness about such products remains limited. Additionally, the perceived shortcomings of formula when compared to breast milk continue to hinder market expansion.

While infant formula offers notable benefits such as convenience, flexibility, and relief from certain dietary restrictions for mothers, it still falls short of replicating the complex nutritional profile and immunological benefits of breast milk. For instance, during the COVID-19 pandemic, studies revealed that antibodies could be transmitted to infants through breast milk, prompting the administration of over 300,000 vaccine doses to pregnant women in India to enhance infant immunity naturally.

Moreover, breast milk remains the “gold standard” in infant nutrition due to its unique biological components, which formula cannot fully replicate. Another critical challenge is the financial burden—annual costs for basic infant formula feeding can reach approximately $1,500, making it less accessible to many families, especially in developing economies.

Top Infant Formula Market Companies

- Nestlé S.A.

- Danone S.A.

- Arla Foods

- Abbott

- The Kraft Heinz Company

- Bellamy’s Organic

- Reckitt Benckiser Group PLC

- Perrigo Company plc

- FrieslandCampina

Get detailed pricing and reports now : https://www.towardsfnb.com/price/5495

Segmentation Analysis

By Ingredient Type

- Carbohydrates: Lactose and maltodextrin are commonly used as energy sources.

- Proteins: Casein, whey protein concentrate, and hydrolyzed protein variants for better digestibility.

- Fats & Oils: Palm oil, coconut oil, DHA/ARA fatty acids crucial for brain and vision development.

- Vitamins & Minerals: Essential for immune support, bone growth, and metabolic function.

- Prebiotics & Probiotics: To promote gut health and enhance immunity.

By Source

- Cow Milk-Based

- Goat Milk-Based

- Plant-Based (Soy, Almond, Rice, etc.)

- Other Specialty Sources (e.g., Hydrolyzed proteins for allergies)

By Form

- Powder

- Liquid Concentrate

- Ready-to-Feed (RTF)

By Application

- Standard Infant Formula

- Follow-On Formula

- Specialty Formula (for allergies, low birth weight, etc.)

- Toddler Formula (12–24 months)

Regional Insights

- North America

A mature market with strong demand for organic and functional formulas. The U.S. leads in innovation, regulatory compliance (FDA standards), and premium infant nutrition products. Increasing cases of infant allergies have driven demand for specialized and hypoallergenic ingredients.

- Europe

Strict food safety regulations and increasing preference for natural, traceable ingredients have made Europe a key region for organic and clean-label infant formulas. Countries like Germany, France, and the U.K. show high per capita expenditure on baby food.

- Asia-Pacific

The fastest-growing market, led by countries like China, India, Indonesia, and Vietnam. Growth is driven by rising disposable income, urbanization, and an increasing number of working mothers. China is the dominant player due to the sheer scale of demand and government approval for imported products.

- Latin America

An emerging market with improving healthcare infrastructure and a growing middle class. Brazil and Mexico are leading in adoption, with multinational companies entering through affordable and fortified infant nutrition options.

- Middle East and Africa

Gradual market development as awareness grows regarding infant health. Gulf countries like UAE and Saudi Arabia show strong uptake of premium and imported formula products, while Sub-Saharan Africa presents opportunities for cost-effective and nutrient-dense ingredients.

Outlook and Future Opportunities

The infant formula ingredient market is poised for consistent growth, propelled by demographic trends, innovation in nutritional science, and evolving parental preferences. As competition intensifies, companies are investing in research-driven, safe, and sustainable ingredient portfolios to capture market share across both mature and emerging economies.

Future success will depend on agility in regulatory compliance, transparent sourcing, and the ability to adapt product offerings to cater to region-specific health needs and cultural sensitivities.